Ethereum has become one of the most prominent cryptocurrencies since its launch in 2015. As the second-largest crypto after Bitcoin in market capitalization, Ethereum has seen its valuation fluctuate wildly during its relatively brief lifespan. The price of Ethereum has been closely tied to major developments on its blockchain, cryptocurrency hype cycles, and broader adoption by developers and enterprises. So what will Ethereum price be next year and further? What price predictions can be made based on historical data? Let’s find out.

Let’s take a look at the major price movements Ethereum has experienced so far and predictions for where its valuation could go in the years ahead.

The History of an Innovative Chain

Since launching in 2015 as the first major smart contract platform, Ethereum has blazed trails in decentralization and expanded crypto’s utility far beyond just payments. Its groundbreaking shift to proof-of-stake aims to further extend Ethereum’s capabilities. While challenges and competitors emerge constantly in the fast-moving crypto sector, Ethereum has proven its resilience time and again. As blockchain adoption advances, Ethereum appears well-positioned to continue playing a leading role in powering decentralized applications and protocols. The future may be uncertain, but Ethereum’s past demonstrates its extraordinary potential.

Ethereum’s Price in the Early Years (2015-2017)

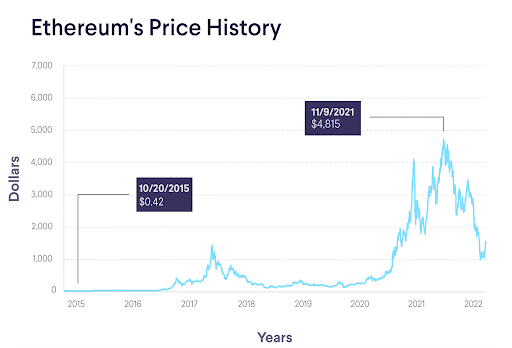

Ethereum first went live in July 2015 after being proposed in 2013 by programmer Vitalik Buterin and launched via a crowd sale in 2014. The native cryptocurrency of the Ethereum network is called Ether (ETH). In the beginning, ETH traded around $2-$3 as enthusiasts began mining and acquiring tokens.

The big catalyst for Ethereum’s price came in early 2017, as interest in cryptocurrencies and blockchain technology exploded. By January 2017, the price crossed $10 for the first time. As hype built around crypto, ETH rallied to nearly $400 by June. After a brief drop, ETH skyrocketed at the end of 2017 amid a broader crypto mania, reaching a record high of $1,448 on January 13, 2018, and establishing itself as a leading cryptocurrency.

The Boom and Bust Cycles of 2018-2020

However, after peaking early in 2018, the crypto markets – including Ethereum – entered an extended bear market. Regulatory concerns, failing ICOs built on Ethereum, and waning hype deflated prices. By December 2018, ETH bottomed out around $85.

This crypto winter lasted through 2019, with Ethereum prices struggling to break above $200. It wasn’t until mid-2020 that Ethereum regained its momentum, driven by growing stablecoin usage and yield farming activity on Ethereum-based DeFi protocols. By August 2020, ETH shot back above $400.

This DeFi-fueled rally peaked in late 2020 and early 2021, with Ethereum reaching a new all-time high of around $1,440 as the crypto sector caught fire again. But the party was short-lived, with the entire crypto market plunging in May 2021, sending ETH back under $2,000. A second rally in late 2021 pushed the price near $5,000 before Ethereum settled around $2,500-$3,500 for most of 2022.

Major Price Drivers

Several key factors have fueled Ethereum’s major price rises and dips over the years:

- Increased utility from DeFi, NFTs, and dApps all being built on Ethereum

- Mainstream crypto adoption bringing in waves of new buyers

- ICO boom and bust cycles driving hype and then disillusionment

- Protocol upgrades like The Merge generate community excitement

- Regulatory and macroeconomic developments impacting investor sentiment

What Will Ethereum’s Price Be in 2023 and Beyond?

Predicting Ethereum’s future price is challenging given the volatility and trends changing rapidly. But analysts expect Ethereum to continue appreciating in value over the long term if adoption increases and the network keeps evolving. Here are some Ethereum price predictions for the next few years:

2023: Most experts predict Ethereum will trade in the range of $2,500-$5,000 next year if crypto markets stabilize. A bullish scenario sees ETH retesting its all-time high of around $5,000.

2025: With scaling solutions rolling out and crypto becoming more mainstream, forecasts call for Ethereum potentially reaching $10,000-$20,000 by 2025.

2030: Some analysts predict Ethereum will hit $50,000-$100,000 within the next decade if adoption continues growing exponentially. But execution risks exist.

The core value proposition of Ethereum lends confidence for a bright future. But predicting exact “Ethereum prices next year” or any year remains highly speculative. While short-term volatility will inevitably persist, Ethereum seems poised for steady gains over the long run as it strengthens its position as the leading programmable blockchain. However, investors should always conduct thorough research rather than just relying on any single price forecast when evaluating investments.

Moridom Digital Agency Agency for Everything Digital

Moridom Digital Agency Agency for Everything Digital